What are 4 steps to personal finance planning?

There are six steps in personal finance planning: EGADIM: Establish financial goal; Gather data; Analyze data; Develop a plan; Implement the plan; Monitor the plan. Establishing the goal is the first step.

There are six steps in personal finance planning: EGADIM: Establish financial goal; Gather data; Analyze data; Develop a plan; Implement the plan; Monitor the plan. Establishing the goal is the first step.

The main elements of a financial plan include a retirement strategy, a risk management plan, a long-term investment plan, a tax reduction strategy, and an estate plan.

By taking the time to save and invest, you can ensure a more stable future for yourself and your loved ones. Let's take a look at some key financial planning tips for four different life stages: early career, mid-career, pre-retirement, and early retirement.

Step 4. Develop a Comprehensive Financial Plan. Proceeding forward, the subsequent step in the financial planning process entails crafting a comprehensive financial plan. This plan should encompass a wide spectrum of both short-term and long-term goals and objectives.

- Step 1: Know Your Numbers. Comparing your income to monthly payments will help you budget for savings. ...

- Step 2: Protect What's Yours. Insurance is the best defense against the unexpected. ...

- Step 3: Fund Your Future. How do you see your retirement? ...

- Step 4: Build Your Wealth.

We at FundWell believe that business owners should take a holistic and proactive approach to their financial wellness. This includes strategic and tactical steps to continually evaluate and improve four key financial indicators: cash flow, credit, customers, and collateral. We call these indicators the 4 C's.

But if you spend too little, you may not enjoy the retirement you envisioned. One frequently used rule of thumb for retirement spending is known as the 4% rule. It's relatively simple: You add up all of your investments, and withdraw 4% of that total during your first year of retirement.

By definition, Personal Financial Planning is a systematic approach whereby an individual maximizes the existing financial resources through proper management of one's finances to best achieve his/her financial goals and objectives.

Finance experts advise that individual finance planning should be guided by three principles: prioritizing, appraisal and restraint. Understanding these concepts is the key to putting your personal finances on track.

What are the 4 routine functions in financial management?

- Financial Planning and Forecasting. ...

- Cash Management. ...

- Cash flow forecasting. ...

- Estimating Capital Expenses. ...

- Determining Capital Structure. ...

- Choosing Sources of Funds. ...

- Procurement of Funds. ...

- Investment of Funds.

To develop successful members of the global society, education must be based on a framework of the Four C's: communication, collaboration, critical thinking and creative thinking.

By continually assessing and controlling your confidence, commitment, concentration and control levels you can positively benefit your psychological mindset during all aspects of a sport and ultimately induce your optimal on field performance.

A retirement account with $2 million should be enough to make most people comfortable. With an average income, you can expect it to last 35 years or more. However, everyone's retirement expectations and needs are different.

You can probably retire at 55 if you have $4 million in savings. This amount, according to conventional estimates, can reliably produce enough income to pay for a comfortable retirement.

Around the U.S., a $1 million nest egg can cover an average of 18.9 years worth of living expenses, GoBankingRates found. But where you retire can have a profound impact on how far your money goes, ranging from as a little as 10 years in Hawaii to more than than 20 years in more than a dozen states.

- Establish Goals.

- Assess Risk.

- Analyze Cash Flow.

- Protect Your Assets.

- Evaluate Your Investment Strategy.

- Consider Estate Planning.

- Implement and Monitor Your Decisions.

- AWM&T: Your Choice for Financial Fitness.

- Define your short- and long-term goals. ...

- Audit your current income, savings, and long-term savings and investing plan. ...

- Address shortfalls/adjust goals. ...

- Account for multiple future scenarios. ...

- Develop a comprehensive financial plan. ...

- Implement and monitor that plan.

- Cash flow and debt management: ...

- Risk management and insurance planning: ...

- Tax planning: ...

- Investment planning: ...

- Retirement savings and income planning: ...

- Estate planning: ...

- Psychology of financial planning:

Personal finance deals with an individual or household's income, spending, and savings. The five fundamental focus areas of personal finance are income, spending, savings, investing, and protection. Understanding a country's tax system can help individuals save a lot of money. This requires proper tax planning.

What are the 10 steps in financial planning?

- Establish goals. What do you want to do with your money? ...

- Evaluate your current financial situation. ...

- Create a spending and savings plan. ...

- Establish an emergency savings fund. ...

- Seek advice and do research. ...

- Make sure you're covered. ...

- Establish a good credit history. ...

- Delete your debt.

- Setting financial goals. ...

- Net worth statement. ...

- Budget and cash flow planning. ...

- Debt management plan. ...

- Retirement plan. ...

- Emergency funds. ...

- Insurance coverage. ...

- Estate plan.

Watch to learn about six personal finance topics that can have a big impact on your life: budgeting, saving, debt, taxes, insurance, and retirement.

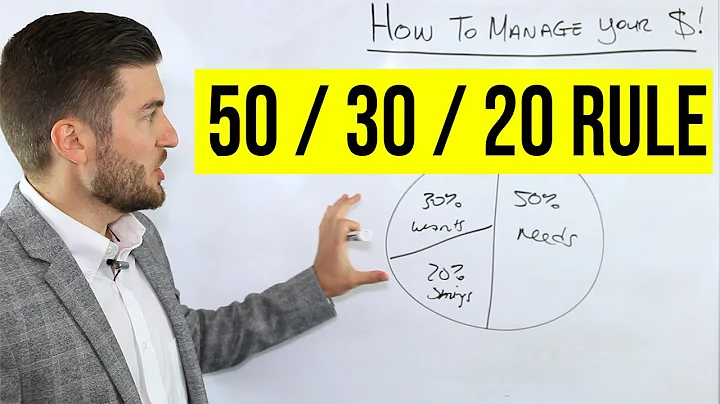

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals. Let's take a closer look at each category.

#1 Don't Spend More Than You Make

When your bank balance is looking healthy after payday, it's easy to overspend and not be as careful. However, there are several issues at play that result in people relying on borrowing money, racking up debt and living way beyond their means.