How does digital payment work?

Digital payments are transactions that take place via digital or online modes, with no physical exchange of money involved. This means that both parties, the payer and the payee, use electronic mediums to exchange money.

Digital payments are transactions that take place via digital or online modes, with no physical exchange of money involved. This means that both parties, the payer and the payee, use electronic mediums to exchange money.

- Reduced Transaction Costs.

- Secure ePayment Transactions.

- Saved Time and Resources.

What Is an Electronic Payment System? Simply put, electronic payments allow customers to pay for goods and services electronically. This is without the use of checks or cash. Normally e-payment is done via debit cards, credit cards or direct bank deposits.

This means that for digital payments to take place, the payer and payee both must have a bank account, an online banking method, a device from which they can make the payment, and a medium of transmission, meaning that either they should have signed up to a payment provider or an intermediary such as a bank or a ...

Are digital payments more secure than offline payments? Digital payments are typically more secure than offline payments for a variety of practical reasons. First, paying for items using physical cash or cards requires that customers carry those items around with them, possibly exposing themselves to robbery.

Helps you keep track of your payments

With cash payments, a person would have to maintain a manual record of every expense they make. But this is very difficult to sustain in the long-term as it's unrealistic to keep track of every small payment you make. Digital payment systems automatically log all your transactions.

Faster payments: Digital payment options like UPI, Debit Cards, etc., are quick to use. They take a few seconds, even for large sums of money, and can be accessed anytime during the day. Safer transactions: New-age payment systems are secure. There is a transparent trail of transactions that helps minimize fraud.

Higher security

Something that is completely missing when using cash. Also, the risk of loss or theft is much lower compared to cash stored in a cash register or bag. Even though your electronic payment means can be stolen as well, the possible damage caused remains more limited.

By implementing encryption, digital payment systems can provide a safe and secure way to make transactions. Authentication: Authentication is the process of verifying the identity of a user, It protects sensitive information, ensures confidentiality, complies with industry standards, and builds trust with customers.

What are the factors of using digital payment?

- Convenience (ability to pay anywhere, anytime) ...

- Speed (transactions are processed faster than traditional methods) ...

- Security (it feels safer than carrying cash or using cards) ...

- Rewards/Incentives (cashback, points, discounts)

- Security Concerns: One of the primary disadvantages of digital payments revolves around security issues. ...

- Technological Infrastructure Gaps: ...

- Digital Divide: ...

- Transaction Costs: ...

- Dependence on Technology: ...

- Privacy Concerns: ...

- Resistance to Change:

Important characteristics for an Internet payment system include security, reliability, scalability, anonymity, acceptability, customer base, flexibility, convertibility, efficiency, ease of integration with applications, and ease of use.

- Credit Card. The most popular form of payment for e-commerce transactions is through credit cards. ...

- Debit Card. Debit cards are the second largest e-commerce payment medium in India. ...

- Smart Card. ...

- E-Wallet.

- PayPal.

- Apple Pay.

- Stripe.

- Google Pay.

- Masterpass.

- Visa Checkout.

- Amazon Pay.

- American Express.

- Bank cards. ...

- Unstructured Supplementary Service Data (USSD) ...

- Aadhaar Enabled Payment System (AEPS) ...

- United Payments Interface (UPI) ...

- Mobile wallets. ...

- Internet and mobile banking.

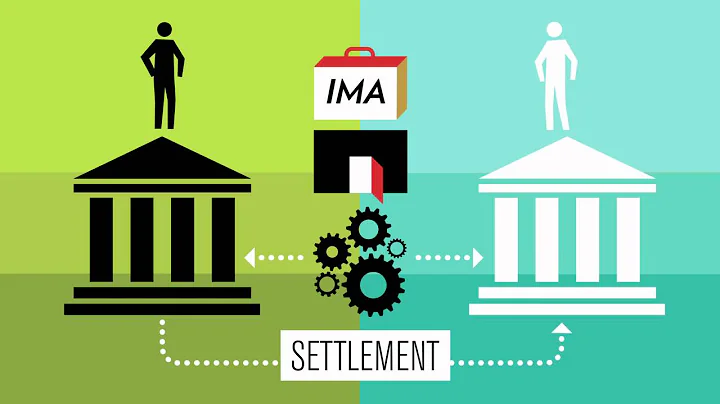

Digital transactions are defined as transactions in which the customer authorizes the transfer of money through electronic means, and the funds flow directly from one account to another. These accounts could be held in banks, or with entities/ providers.

Peer-to-peer (P2P) payment apps allow users to send, receive, and request money directly to and from others. Before using one of these apps, you must first link your bank account or credit or debit card. It's important to only use trusted P2P apps and to only send money to people you know and trust.

It is a digital currency that can be used in the same way as physical banknotes but without the physical element.

- PayPal. Safe and secure.

- Credit card. Well protected against fraudulent transactions.

- Debit card. Great for controlling your spending.

- Prepaid card. Provides a certain level of privacy.

- Digital wallets. ...

- Mobile payment apps. ...

- Cryptocurrencies.

What is payment risk?

Payment risk refers to the potential of losses due to a contract default or other payment event such as fraud, security breaches or chargebacks. Companies regularly handling a high volume of online payments are subject to such risks.

Other factors include a distrust of digital payments due to concerns about fraud, personal errors or privacy. Some people don't have the relevant financial or digital skills to use digital payments. And some simply don't have access to digital and financial infrastructure, such as adequate broadband or a bank account.

Cash is not subject to security breaches like digital payments are since there is no system to breach. However, physical money can be stolen, even though there is no risk of sensitive details being stolen if that happens. Digital payments are a very convenient option for many people.

For the first time, more than nine out of ten consumers say they have used some form of digital payment over the course of the year. This metric has grown steadily over the survey's eight years and accelerated during pandemic lockdowns. It first exceeded 80 percent of consumers in 2021.

In conclusion, virtual payments offer many advantages, including convenience, security, and reduced costs. However, there are several disadvantages to consider, such as technical issues, security risks, and limited consumer protection.