Can a bank reverse a returned check?

If your bank credited your account for a check that was later returned unpaid for insufficient funds, the bank can reverse the funds and may charge a fee. As the payee, you must pursue the maker of the check if you wish to seek reimbursem*nt.

Generally, a bank may attempt to deposit the check two or three times when there are insufficient funds in your account. However, there are no laws that determine how many times a check may be resubmitted, and there is no guarantee that the check will be resubmitted at all.

When you cash or deposit a check and there's not enough funds to cover it in the account it's drawn on, this is also considered non-sufficient funds (NSF). When a check is returned for NSF in this manner, the check is generally returned back to you. This allows you to redeposit the check at a later time, if available.

If you can prove the bank made an error that resulted in returned items and fees, they will refund the charges and write a letter to each payee stating the returned item was the bank's error.

Send a “bad check” demand letter: If you're having trouble getting a response from the check issuer, send them a bad check demand letter. This is a formal request for payment, sent by certified mail to the issuer. In the letter, include as many details as possible.

If your financial institution doesn't cover the check, it bounces and is returned to the depositor's bank. You'll likely be charged a penalty for the rejected check; this is a nonsufficient funds fee, also known as an NSF or returned item fee. This costs about the same as an overdraft fee — around $35.

A returned check is a check that the receiving bank does not honor. If you're the check writer, having a check boomerang means that your bank will not pay the person or business to whom you wrote it. If you are the payee, a returned check is one for which you won't get paid—at least not right away.

A bounced check is slang for a check that cannot be processed because the account holder has non-sufficient funds (NSF) available for use. Banks return, or “bounce,” these checks, also known as rubber checks, rather than honor them, and banks charge the check writers NSF fees.

Returned check fees can also be used to discourage you from writing bad checks. Who pays a returned check fee? Normally, the check writer is responsible for covering the fee. However, the person who attempts to deposit a bad check can also face penalties.

Checks can be processed within just a few business days, so you could know whether a check bounces or not within a week or less. Often banks make a portion of the check amount available as soon as the next business day, while the rest is put on hold until the check clears.

Do banks forgive bounced checks?

If this is your first time bouncing a check, your bank might be more lenient about forgiving your nonsufficient funds or overdraft fee. If this has been a pattern of behavior, however, then your bank might become more stringent about requiring that you pay your overdraft or nonsufficient funds fee.

Generally, if your bank credited your account, it can later reverse the funds if the check is found to be fraudulent. You should check your deposit account agreement for information on the bank's policies regarding fraudulent checks.

When you write a bad check, it's returned to the bank unpaid, resulting in a returned check fee. If you don't have enough money but your bank approves your payment anyway, you may be charged an overdraft fee instead. The average returned check fee ranges from $10 to $50, while overdraft fees are typically around $35.

Once a check has cleared, it cannot be reversed unless fraud or identity theft is suspected. However, many banks will make the first $225 of a check deposit available for immediate use. Looking to pay off debt or make a budget?

If you have received a notice of a bad check from your bank, you must first contact the person who gave you the bad check. It is recommended that you call them and write them a letter detailing the situation at hand.

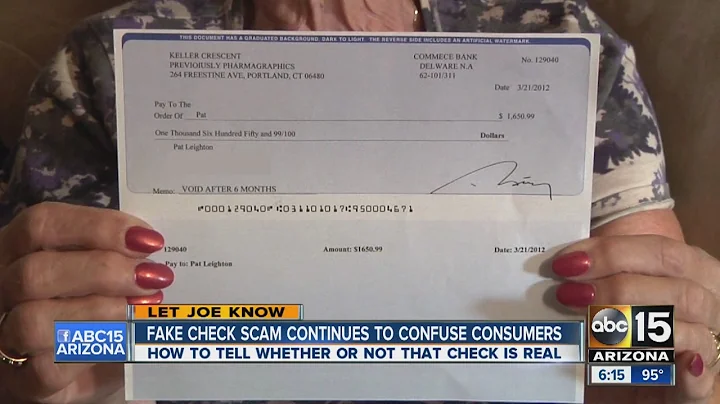

After you've deposited the money (and potentially spent it or sent it to someone else), the bank inspects the check and finds that it isn't legitimate. Then, the bank debits your account for the amount of the fake check, and may also charge you a processing fee.

Insufficient Funds: The most common reason for a check reversal is that the check you deposited did not clear due to insufficient funds in the payer's account.

You're charged the fee to discourage you from writing bad checks in the future and compensate the bank for the administrative work associated with returning the check. Some merchants who receive bad checks will attempt to deposit them a second time in hopes of receiving their money.

(1) Except as provided in paragraph (d) of this section, if a paying bank determines not to pay a check, it shall return the check in an expeditious manner such that the check would normally be received by the depositary bank not later than 2 p.m. (local time of the depositary bank) on the second business day following ...

You probably will be able to tell how your check was processed, after the fact, by looking at your bank statement. Your bank is required to list every EFT transaction in your monthly bank statement, including the dollar amount, the date the transaction cleared, and the name of the recipient.

How long does a bank have to return a check for improper endorsem*nt?

The bank must either pay the check or return it by its midnight deadline (Revised UCC § 4-301). The mid- night deadline is midnight of the banking day following the banking day the check is presented for payment (Revised UCC § 4-104(10)).

A bounced check will result in a rejected payment, as well as fees from your financial institution and often, from the merchant you were trying to pay. You may also incur late fees, depending on the situation, and could even have the late payment reported to the credit bureaus.

If your employer doesn't pay you the owed wages immediately after the check bounces, it will owe you an extra day of wages for each and every day you remain unpaid (in addition to the amount of the paycheck itself).

If you do accidentally double deposit a check, once the bank finds out, the money from your second deposit will be deducted from your account. If you don't have enough to cover the deduction, and it appears you are knowingly committing fraud, that's when legal or other problems could start.

Normally, the check writer is responsible for covering the fee. However, the person who attempts to deposit a bad check can also face penalties. For instance, say you're on the receiving end of a bad check. You deposit the check into your bank account in good faith, assuming the amount will be credited to you.